Key Takeaways

- Bahrain’s SEO landscape in 2025 is driven by AI integration, mobile-first strategies, and localised content optimisation.

- Businesses are shifting towards Arabic SEO and voice search to better engage the region’s growing digital audience.

- Investing in data-driven SEO tools and local partnerships is crucial for staying competitive in Bahrain’s digital market.

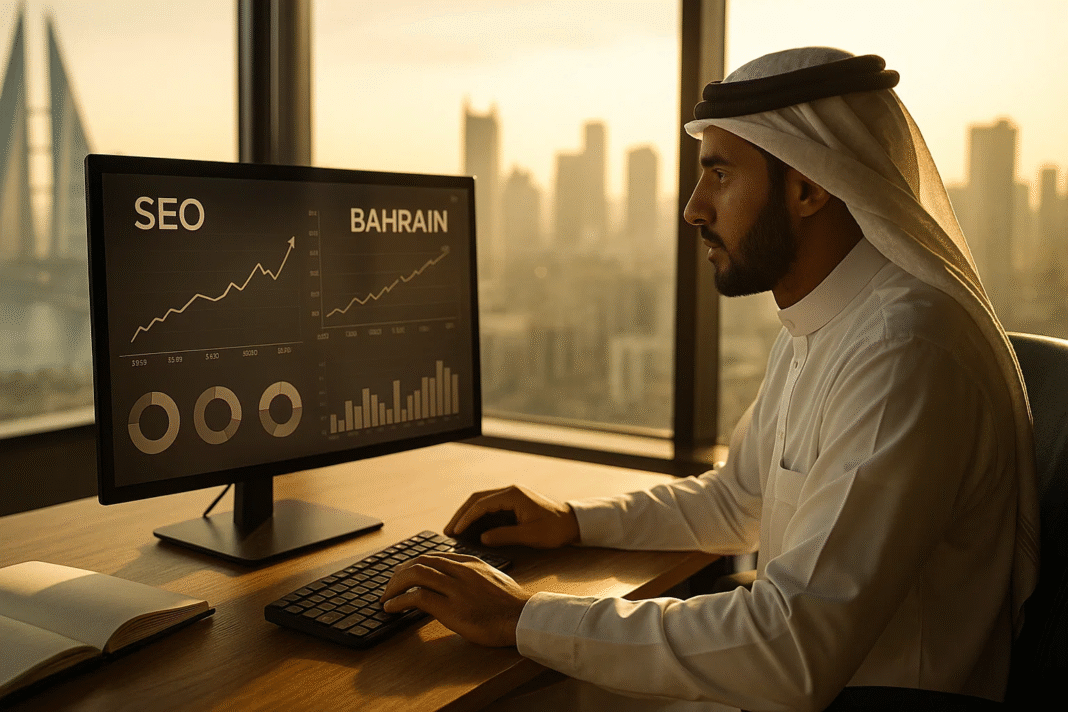

In 2025, Bahrain stands at the crossroads of digital evolution and economic diversification, and search engine optimization (SEO) has emerged as a critical pillar supporting this transformation. As businesses across sectors—from finance and hospitality to healthcare and e-commerce—pivot towards digital-first strategies, the role of SEO in ensuring online visibility, consumer engagement, and revenue generation has never been more pronounced. Bahrain’s proactive digital agenda, bolstered by Vision 2030 and a tech-forward government, has laid the groundwork for a thriving SEO ecosystem that is both ambitious and fast-evolving.

Despite being one of the smaller markets in the Gulf Cooperation Council (GCC), Bahrain’s digital competitiveness is accelerating. With a tech-savvy population, mobile penetration exceeding 100%, and one of the highest internet usage rates in the region, Bahraini businesses are increasingly turning to SEO to reach their audiences more effectively and cost-efficiently. In a landscape where Google maintains dominant search engine market share and where mobile-first behavior is standard, mastering the art and science of SEO is no longer optional—it is imperative.

In recent years, the SEO landscape in Bahrain has seen significant shifts. Algorithm updates, AI-powered search experiences, the rise of zero-click results, and user-intent-driven content are redefining the way SEO strategies are crafted and executed. Bahraini brands are recognizing the importance of not only ranking for the right keywords but also offering authoritative, localized, and value-driven content. This is especially relevant in a multilingual environment, where the interplay between English and Arabic SEO can be the defining factor in capturing regional market share.

Moreover, competition in the digital space is intensifying. Both local enterprises and global brands operating in Bahrain are investing in advanced SEO tools, technical audits, content marketing, and performance tracking. SEO agencies in the Kingdom are also maturing, offering services that range from on-page optimization and structured data implementation to advanced link-building strategies and Core Web Vitals enhancements. For businesses navigating this dynamic terrain, understanding the current state of SEO in Bahrain provides a strategic edge.

This comprehensive market analysis explores the state of SEO in Bahrain in 2025 by examining key trends, technological advancements, consumer behavior shifts, local SEO dynamics, and competitive agency landscapes. From mobile-first indexing to voice search optimization and from Arabic-language SEO challenges to AI-generated content regulation, this report offers deep insights into the forces shaping the future of search in the Kingdom.

Whether you are a local business owner aiming to boost online visibility, a digital marketing strategist exploring regional trends, or a global brand looking to enter the Bahraini market, this blog will equip you with the knowledge and foresight to navigate the complex and competitive SEO environment in Bahrain. As we delve into the data, industry commentary, and actionable insights, it becomes clear that Bahrain is not just keeping pace with global SEO trends—it is actively shaping them within its unique digital and cultural context.

But, before we venture further, we like to share who we are and what we do.

About AppLabx

From developing a solid marketing plan to creating compelling content, optimizing for search engines, leveraging social media, and utilizing paid advertising, AppLabx offers a comprehensive suite of digital marketing services designed to drive growth and profitability for your business.

At AppLabx, we understand that no two businesses are alike. That’s why we take a personalized approach to every project, working closely with our clients to understand their unique needs and goals, and developing customized strategies to help them achieve success.

If you need a digital consultation, then send in an inquiry here.

The State of SEO in Bahrain: A 2025 Market Analysis

- Bahrain’s Digital Foundation in 2025: The Bedrock for SEO Growth

- Mobile vs. Desktop Internet Usage in Bahrain (2025): Strategic Implications for SEO

- Search Engine Market Share in Bahrain (2025): Strategic Priorities for SEO

- E-Commerce Sector in Bahrain (2025): Strategic SEO Implications in a Rapidly Expanding Market

- The Finance Industry in Bahrain (2025): SEO’s Strategic Role in a Digitally Transforming Sector

- Tourism Sector in Bahrain (2025): SEO as a Strategic Enabler of National Growth Targets

- Oil and Gas Sector in Bahrain (2025): SEO’s Emerging Role in a Digitally Underserved Industry

- Emerging Industries in Bahrain (2025): Broadening the Scope of SEO in a Diversifying Economy

- Investment in Digital Advertising and Search Engine Marketing in Bahrain: 2025 Analysis

- Adoption and Effectiveness of SEO Practices by Bahraini Businesses in 2025

- Future Trends and Outlook for SEO in Bahrain: 2025 and Beyond

- Government Initiatives and Regulations Shaping Bahrain’s Digital Landscape and SEO Outlook in 2025

- Navigating the SEO Landscape in Bahrain: A Strategic Outlook for 2025

- Strategic Recommendations for Businesses: Maximizing SEO Impact in Bahrain (2025 and Beyond)

1. Bahrain’s Digital Foundation in 2025: The Bedrock for SEO Growth

Bahrain’s digital environment in 2025 provides a strong and fertile ground for SEO-driven business strategies. With nearly universal internet access, fast connection speeds, and deep mobile penetration, the Kingdom presents a dynamic setting where search visibility defines digital success.

1. Internet Penetration and Digital Consumption Trends

Widespread Internet Accessibility

- Internet penetration rate reached 99.0% in early 2025, equivalent to 1.61 million active users.

- Reflects a digitally mature society with high online engagement.

- Businesses lacking strong online visibility risk marginalization in a highly connected ecosystem.

Annual Internet User Growth

- Between January 2024 and January 2025, internet users increased by 38,000 (+2.4% YoY).

- Indicates steady expansion of the digital audience and increasing demand for online information and services.

- Highlights the intensifying need for precise, intent-driven SEO strategies to capture growing demand.

SEO Opportunity Snapshot

| Metric | Value | Strategic SEO Implication |

|---|---|---|

| Internet Penetration | 99.0% | Search is a universal behavior – SEO has mass reach |

| Growth in Online Users (YoY) | +2.4% | Emerging audience segments must be targeted early |

| Active Internet Users | 1.61 million | Robust market size for organic search traffic optimization |

2. Mobile Connectivity and Search Behavior

High Mobile Connectivity

- 2.52 million mobile connections in early 2025 – 155% of population, indicating multiple devices per user.

- High mobile access translates to frequent, on-the-go search activity.

- SEO strategies must be mobile-first, with attention to UX, site speed, and responsive design.

Broadband-Enabled Mobile Usage

- 99.2% of mobile connections are 3G, 4G, or 5G enabled.

- Seamless mobile experiences drive expectations for fast-loading, mobile-optimized content.

Median Mobile & Fixed Internet Speeds (2025)

| Connection Type | Download Speed (Mbps) | SEO Relevance |

|---|---|---|

| Mobile Internet | 118.36 Mbps | Supports fast rendering of content-heavy webpages |

| Fixed Broadband | 86.33 Mbps | Enables rich multimedia experiences and long-form SEO |

SEO Imperatives for Mobile Search

- Prioritize Core Web Vitals and mobile performance audits.

- Implement accelerated mobile pages (AMP) and progressive web apps (PWA) where relevant.

- Ensure content structure supports voice search optimization.

3. Digital Content Accessibility and User Behavior

Digital Content Consumption

- With high-speed internet, users engage with interactive and multimedia-rich formats including video, image carousels, and dynamic content.

- SEO content strategies must be versatile, incorporating:

- Structured data (schema markup)

- Optimized image/video SEO

- Keyword clustering across topical themes

Social Media vs. Search Engine Use

- 73.2% of Bahrain’s population actively uses social media.

- Indicates a 25.8% gap between total internet users and social media participants.

- Suggests a larger segment relies more on search engines than social platforms for content discovery.

Channel Engagement Matrix

| Platform Type | % of Population | Engagement Role | SEO Strategic Value |

|---|---|---|---|

| Internet (All Users) | 99.0% | Universal content access | SEO = Foundational digital touchpoint |

| Social Media | 73.2% | Entertainment, community, updates | Supplemental to SEO; less transactional |

| Search Engines | ~90–95% (est.) | Information retrieval, intent-driven | Primary interface for business discovery |

4. Strategic Implications for SEO in Bahrain

Market Readiness for SEO Integration

- Bahrain’s high-speed infrastructure and digital fluency make it uniquely positioned for advanced SEO implementation.

- SEO can serve as a cost-effective alternative to paid ads, especially for SMEs and startups aiming for long-term ROI.

Key Strategic SEO Priorities in Bahrain (2025)

- Local SEO: Targeting hyper-local queries, especially in Arabic, is essential for service-based businesses.

- Arabic Language Optimization: Bridging content quality and keyword strategy for native speakers.

- Technical SEO: Addressing speed, crawlability, and indexing for mobile and desktop.

- Content Authority: Building topic clusters, backlinks, and E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness).

5. The Path Forward: SEO as a Growth Lever

Bahrain’s digital environment in 2025 reflects a technologically forward-thinking, mobile-first nation ready to embrace advanced SEO methodologies. Businesses operating in this ecosystem must view SEO not as an auxiliary tool, but as the cornerstone of digital discoverability and growth. The convergence of mobile dominance, broadband availability, and multilingual online behavior provides a powerful context for tailored, localized, and data-driven SEO strategies.

As the competition for digital visibility intensifies, those who invest in strategic SEO in Bahrain today will shape the online marketplace of tomorrow.

2. Mobile vs. Desktop Internet Usage in Bahrain (2025): Strategic Implications for SEO

As Bahrain continues to advance its digital infrastructure, user behavior data reveals a decisive and consistent shift toward mobile internet usage. From a third-party analytical perspective, this device preference trend holds critical strategic significance for search engine optimization (SEO) in the Bahraini market. Mobile-first behavior is no longer emerging—it is firmly entrenched.

1. Device Usage Trends: A Month-by-Month Breakdown (2025)

Mobile Usage Dominance: A Clear Pattern

- StatCounter analytics from Q1 2025 reveal an unwavering trend favoring mobile devices:

- January 2025: Mobile – 72.15%, Desktop – 27.85%

- February 2025: Mobile – 71.02%, Desktop – 28.98%

- March 2025: Mobile – 70.29%, Desktop – 29.71%

- This consistency across months illustrates the maturity of Bahrain’s mobile-first ecosystem.

Annual Trend Snapshot (2024 vs. 2025)

| Month | Mobile Usage (%) | Desktop Usage (%) | SEO Insight |

|---|---|---|---|

| Jan 2025 | 72.15 | 27.85 | Strong mobile bias – prioritize mobile UX/UI |

| Feb 2025 | 71.02 | 28.98 | Minor fluctuation – desktop remains secondary |

| Mar 2025 | 70.29 | 29.71 | Mobile dominance remains consistent |

| Jan–Dec 2024* | ~71.5 (avg.) | ~28.5 (avg.) | Year-long consistency confirms sustained user behavior |

*Average based on available year-end reporting data from StatCounter

2. Strategic SEO Implications of Bahrain’s Mobile-First Behavior

Mobile-Centric User Behavior

- Over 70% of all internet traffic in Bahrain originates from mobile devices, a trend reinforced month after month.

- Indicates that the majority of Bahraini users:

- Conduct searches via smartphones

- Browse, shop, and engage with websites on smaller screens

- Expect rapid page loads and intuitive navigation

SEO Must Align With Mobile Expectations

- Search engines—especially Google—prioritize mobile-first indexing, making mobile optimization non-negotiable.

- Bahraini businesses must:

- Ensure responsive design across all devices

- Compress images and assets to enhance page load speeds

- Structure content with mobile readability in mind (short paragraphs, collapsible menus, bold headers)

Mobile Optimization Checklist for Bahraini SEO Strategies

| SEO Element | Mobile Optimization Recommendation |

|---|---|

| Site Structure | Use responsive layouts, flexible grids |

| Page Load Speed | Optimize Core Web Vitals; eliminate render-blocking code |

| UX/UI Design | Simplify menus, enhance thumb-friendly navigation |

| Content Presentation | Use scannable formatting: bullet points, headings, spacing |

| Structured Data Markup | Implement schema for FAQs, products, and articles |

| Local SEO | Optimize for “near me” mobile searches and Google Maps |

3. Historical Consistency: A Multi-Year Mobile Usage Trend

2024: Establishing the Baseline

- StatCounter’s 2024 data indicates that mobile usage consistently exceeded 70% throughout the year.

- Demonstrates that Bahrain’s mobile-first behavior is not a temporary spike, but a structural feature of its digital ecosystem.

Trend Matrix: Bahrain’s Device Usage Over Time

| Year | Avg. Mobile Share | Avg. Desktop Share | Trend Status | Business Urgency Level |

|---|---|---|---|---|

| 2023 | ~68% | ~32% | Rising mobile adoption | High |

| 2024 | ~71.5% | ~28.5% | Mobile established | Critical |

| 2025 (Q1) | ~71% | ~29% | Entrenched mobile-first | Mandatory |

4. Business Risks of Ignoring Mobile Optimization

SEO Penalties and Conversion Losses

- Google ranks websites lower on mobile search if:

- They load slowly on mobile

- Offer poor user experience or have excessive popups

- Poor mobile UX leads to:

- Increased bounce rates

- Lower engagement duration

- Reduced conversion rates, especially for e-commerce and lead generation

Competitive Disadvantage

- Brands failing to optimize for mobile are effectively invisible to the majority of Bahraini users.

- Competitors embracing mobile-first SEO will dominate high-intent, transactional, and location-based search queries.

5. Conclusion: Bahrain’s Mobile Landscape as a Strategic SEO Lever

Bahrain’s digital terrain in 2025 is unequivocally mobile-dominant, shaped by consistent behavioral data and supported by widespread high-speed connectivity. Businesses targeting the Bahraini market must embed mobile optimization at the core of their SEO strategies, from technical implementation to content formatting and local search targeting.

Ignoring this mobile-first reality is not simply a missed opportunity—it constitutes a strategic failure in a market where search behavior is overwhelmingly driven by smartphones. The future of SEO in Bahrain hinges on a brand’s ability to deliver fast, seamless, and responsive mobile experiences that meet user expectations and align with modern search engine algorithms.

3. Search Engine Market Share in Bahrain (2025): Strategic Priorities for SEO

Understanding the distribution of search engine usage in Bahrain is essential for developing focused and efficient SEO strategies. In 2025, the Bahraini search engine landscape is overwhelmingly dominated by Google, establishing it as the central platform for digital visibility. However, a deeper, segmented analysis of market share across device types reveals strategic nuances that businesses must consider when optimizing their digital presence.

1. Overall Search Engine Market Share in Bahrain (March 2025)

Google: The Primary Gateway to Online Search

- Google commands an overwhelming 96.27% of the total search engine market share across all devices (desktop, mobile, and tablet).

- This near-monopolistic position reinforces the need for Bahrain-focused SEO campaigns to align with Google’s evolving algorithmic priorities.

Secondary Players and Their Marginal Influence

- Bing holds a minor share of 3.00%, making it the only alternative engine with notable presence.

- Other engines:

- YANDEX: 0.27%

- Yahoo!: 0.21%

- DuckDuckGo: 0.15%

- These platforms have limited strategic value in mainstream SEO efforts but may be relevant for niche or privacy-conscious demographics.

Search Engine Market Share Matrix – All Devices (March 2025)

| Search Engine | Market Share (%) | SEO Focus Level | Strategic Value |

|---|---|---|---|

| 96.27 | Primary | Critical for visibility | |

| Bing | 3.00 | Secondary | Consider for B2B/desktop |

| YANDEX | 0.27 | Tertiary | Minimal impact |

| Yahoo! | 0.21 | Tertiary | Limited relevance |

| DuckDuckGo | 0.15 | Tertiary | Niche/privacy-first users |

2. Device-Specific Market Share: A Deeper Perspective

Analyzing search engine usage by device type uncovers important distinctions in user behavior, platform preferences, and strategic SEO implications.

A. Desktop Search Market (February 2025)

- Google maintains a reduced, yet dominant, market share of 89.74%.

- Bing gains stronger traction at 9.34%, likely due to:

- Default browser settings (e.g., Edge on Windows)

- Enterprise and institutional environments

- Yahoo! registers 0.51%, indicating marginal usage.

SEO Consideration for Desktop-Focused Campaigns:

- B2B sectors and enterprise services targeting desktop users may benefit from dual-platform optimization (Google + Bing).

Desktop Search Engine Share – February 2025

| Search Engine | Market Share (%) | Key Notes |

|---|---|---|

| 89.74 | Still dominant, but slightly weaker | |

| Bing | 9.34 | Stronger desktop foothold |

| Yahoo! | 0.51 | Minimal influence |

B. Mobile + Tablet + Console Search (February 2025)

- Google’s dominance is even more pronounced on mobile devices, with 99.18% market share.

- Other engines:

- YANDEX: 0.29%

- Bing: 0.22%

Key Insight:

- Mobile search in Bahrain is almost exclusively powered by Google.

- Reinforces the need for mobile-first SEO strategies focused on:

- Core Web Vitals

- Responsive design

- Page speed optimization

- Voice search readiness

Mobile Search Engine Share – February 2025

| Search Engine | Market Share (%) | SEO Implication |

|---|---|---|

| 99.18 | Absolute dominance, critical to SEO | |

| YANDEX | 0.29 | No strategic SEO priority |

| Bing | 0.22 | Marginal presence |

3. Visual Comparison: Search Engine Share by Device Type

Bar Chart: Google vs. Competitors by Device (2025 Q1)

(Illustrative comparison based on available data)

| Google Bing Others

| Mobile/Tablet ████████ ▏ ▏

| Desktop ███████ ▋ ▏

| All Devices ████████ ▎ ▏

4. Strategic Takeaways for SEO in Bahrain

Google-Centric SEO is Mandatory

- Given Google’s commanding control of both mobile and desktop searches:

- Businesses must prioritize compliance with Google’s ranking systems (e.g., Helpful Content Updates, E-E-A-T, Core Web Vitals).

- Structured data, mobile UX, and high-quality content are essential pillars.

Bing Optimization: Niche but Worthwhile

- Particularly relevant for:

- B2B firms targeting desktop-heavy traffic

- Businesses leveraging Microsoft products or enterprise IT ecosystems

Minor Engines: Low Priority

- Search engines like DuckDuckGo, Yahoo!, and Yandex hold negligible influence in Bahrain.

- SEO investments in these platforms are unlikely to yield ROI unless targeting ultra-specific niches.

5. Conclusion: Targeting the Search Engines That Matter Most

In the context of Bahrain’s digital economy in 2025, Google functions as the de facto gatekeeper to online visibility. Its nearly complete market dominance across all devices—particularly in mobile search—dictates that SEO strategies must be designed with Google’s search ecosystem at the forefront.

While Bing commands a minor, device-specific presence, especially on desktops, it remains secondary in strategic importance. Businesses that want to maintain relevance, capture traffic, and convert users in Bahrain must view Google-centric, mobile-optimized SEO as a non-negotiable foundation of their digital strategy.

Failing to do so means missing out on the overwhelming majority of search-driven interactions in one of the GCC’s most digitally advanced nations.

4. E-Commerce Sector in Bahrain (2025): Strategic SEO Implications in a Rapidly Expanding Market

The e-commerce landscape in Bahrain is undergoing a transformative evolution, driven by rising digital adoption, supportive government policies, and the increasing reliance of consumers on online platforms for retail experiences. From a third-party analytical perspective, Bahrain’s e-commerce ecosystem in 2025 presents not only a rapidly growing market but also a highly competitive arena where SEO has emerged as an indispensable strategic asset.

1. Market Size and Future Projections: A Billion-Dollar Opportunity

Valuation of the E-Commerce Sector

- As of 2025, the Bahraini e-commerce market is valued at approximately USD 1.2 billion.

- Forecasts project the market to reach USD 2.3 billion by 2032, reflecting immense growth potential across the next decade.

Compound Annual Growth Rate (CAGR)

- The sector is projected to grow at a CAGR of 7.8% from 2025 to 2032, indicating sustained digital commerce momentum.

- This growth is driven by increasing consumer demand, enhanced payment systems, and digital literacy.

Market Forecast Table

| Year | Market Size (USD Billion) | YoY Growth (%) | Strategic Insight |

|---|---|---|---|

| 2025 | 1.2 | – | Established digital marketplace |

| 2028 (est.) | 1.6 | ~8% | Scaling opportunities for mid-size businesses |

| 2032 (est.) | 2.3 | ~7.8% CAGR | Long-term SEO investment yields cumulative gains |

2. Growth Drivers Shaping Bahrain’s E-Commerce Ecosystem

Core Factors Fueling Market Expansion

- Internet Penetration:

- With internet access reaching 99% of the population, the majority of consumers are digitally connected and actively engage in online shopping.

- Mobile Commerce Adoption:

- Over 2.5 million mobile connections, accounting for 155% of the population, highlight the prevalence of smartphones in digital transactions.

- Governmental Digital Transformation Initiatives:

- Strategic programs aligned with Bahrain’s Vision 2030 promote:

- E-payment standardization

- SME digital adoption

- National e-commerce platforms

- Strategic programs aligned with Bahrain’s Vision 2030 promote:

Growth Driver Matrix

| Growth Driver | Relevance to E-Commerce | SEO Implication |

|---|---|---|

| Internet Penetration | High | Broad audience reach through search visibility |

| Smartphone Penetration | Very High | Mobile-first SEO strategies are essential |

| Government Digital Strategy | Supportive | SEO for government-backed platforms/businesses |

3. Competitive Landscape: Dominance, Disruption, and Differentiation

Key Market Players

- The Bahraini market features a blend of international e-commerce leaders and agile regional/local firms.

- Notable participants include:

- Amazon, Noon, Namshi – Offering wide product selection and logistic scalability

- Talabat, Carrefour, Lulu Hypermarket – Focused on groceries and fast-moving consumer goods

- WafiApps, Bahrain E-Mall – Regional platforms with localized offerings

Market Concentration and Competitive Intensity

- Global platforms possess significant brand authority, robust SEO infrastructures, and large backlink profiles.

- Local competitors leverage Arabic-language content, localized UX, and proximity-based logistics to remain competitive.

Competitor Landscape Chart

| Category | Brand Examples | Strengths | SEO Strategy Focus |

|---|---|---|---|

| Global Giants | Amazon, Noon, Namshi | Trust, reach, technical SEO, brand authority | SERP dominance through link equity |

| Regional Players | Talabat, Carrefour, Lulu | Logistics, product variety, app integration | Geo-specific and product-based keywords |

| Local Platforms | WafiApps, Bahrain E-Mall | Local knowledge, Arabic-first interfaces | Local SEO, schema markup, and Arabic content |

4. Strategic SEO Imperatives for Bahraini E-Commerce Players

Optimizing for a Digitally Native Audience

- With a growing mobile-first user base, SEO strategies must prioritize:

- Responsive design across all devices

- Fast-loading product pages and secure HTTPS protocols

- Integration of structured data (e.g., Product, Offer, Review schema)

Localized SEO in a Bilingual Environment

- Bahrain’s e-commerce market operates in both English and Arabic, requiring:

- Keyword research tailored for Arabic search queries

- Hreflang tags for multilingual content differentiation

- Local content strategies based on cultural relevance

Conversion-Focused SEO Components

- Strong SEO must support:

- Product page indexing

- Category page optimization

- Internal linking for crawlability

- User-generated content (e.g., reviews, Q&A)

5. The Role of SEO in E-Commerce ROI and Market Penetration

SEO as a Revenue Multiplier

- Compared to paid channels (PPC, display ads), SEO offers:

- Long-term traffic acquisition

- Higher trust and click-through rates

- Lower cost-per-acquisition (CPA) over time

SEO ROI Comparison Table

| Marketing Channel | Initial Cost | Sustainability | Long-Term ROI | Traffic Dependence |

|---|---|---|---|---|

| SEO | Medium | Very High | High | Organic + Intent |

| Paid Ads (PPC) | High | Low | Medium | Paid-only |

| Social Media Ads | High | Low | Low–Medium | Interruption-based |

6. Conclusion: E-Commerce and SEO—A Strategic Convergence in Bahrain’s Digital Future

Bahrain’s e-commerce sector, poised to double in value by 2032, offers unprecedented opportunities for businesses that understand and act upon the digital behaviors shaping consumer commerce. In a landscape marked by rapid technological adoption and intensifying competition, SEO is not merely a digital tactic—it is a foundational pillar of sustainable e-commerce growth.

By aligning SEO strategies with Bahrain’s evolving digital ecosystem—through mobile optimization, local language targeting, and competitive SERP positioning—retailers can secure long-term visibility, increase sales conversion rates, and differentiate themselves in an increasingly crowded marketplace. The era of transactional websites is giving way to search-optimized digital storefronts, and in Bahrain, the time to lead in that transformation is now.

5. The Finance Industry in Bahrain (2025): SEO’s Strategic Role in a Digitally Transforming Sector

Bahrain’s finance industry in 2025 is navigating a period of accelerated digital transformation, driven by regulatory innovation, technological disruption, and the increasing digitalization of customer behavior. As financial institutions—both traditional and fintech—compete for relevance, trust, and visibility, the imperative to establish a search-optimized online presence has never been more pressing. From a third-party analytical perspective, SEO has evolved into a mission-critical strategy for institutions seeking sustainable market advantage in Bahrain’s finance sector.

1. Structural Transformation in the Financial Sector

Mergers, Acquisitions, and Market Consolidation

- The financial services landscape in Bahrain is experiencing notable mergers and acquisitions, reshaping competitive dynamics.

- Consolidation efforts are aimed at:

- Expanding customer bases

- Diversifying service portfolios

- Enhancing regional influence

- These transitions necessitate rebranding, domain migration, and technical SEO recalibration to avoid visibility loss during digital consolidation.

SEO Implications of M&A Activity

- Post-merger digital realignments require:

- URL restructuring with 301 redirects

- Metadata and schema updates for brand coherence

- Reputation management through SERP monitoring and optimization

SEO Readiness Matrix for Merged Financial Entities

| SEO Element | Importance Post-Merger | Action Required |

|---|---|---|

| Domain Consolidation | Critical | Implement 301 redirects and update sitemaps |

| Brand Keyword Optimization | High | Align old/new brand keywords in page titles |

| Technical SEO Audit | Essential | Identify crawl errors and indexing issues |

| Backlink Reclamation | Important | Monitor and restore broken inbound links |

2. Fintech Ascendancy and the Digital Finance Ecosystem

Fintech as the Vanguard of Digital Finance

- Fintech firms are disrupting traditional banking models by offering user-centric, tech-enabled solutions.

- Their operational model is built on:

- Online-first customer acquisition

- App-based service delivery

- Agile product innovation cycles

Regulatory and Infrastructure Support

- Bahrain’s Central Bank of Bahrain (CBB) has created a favorable fintech regulatory sandbox, enabling innovation and experimentation.

- Bahrain FinTech Bay, one of the region’s largest fintech hubs, acts as an accelerator for:

- Startups and scale-ups in digital finance

- International tech entrants seeking regional expansion

Digital Infrastructure Impact on SEO

- Fintech firms rely on SEO for:

- Organic customer acquisition

- Educational content visibility (blogs, knowledge centers)

- Authority building through linkable fintech resources

SEO-Fintech Synergy Table

| Fintech Activity | SEO Role | Resulting Benefit |

|---|---|---|

| Launching new products | Optimized landing pages | High-converting organic traffic |

| Financial education blogs | Informational keyword targeting | Authority and trust building |

| Fintech API documentation | Structured data markup | Enhanced visibility in developer searches |

| Mobile-first services | Core Web Vitals optimization | Improved ranking and UX on smartphones |

3. Traditional Banks and Digital Catch-Up Strategies

Adapting to the Fintech Disruption

- Established banks in Bahrain are increasingly:

- Launching digital banking arms

- Investing in content-rich websites

- Integrating AI-powered chatbots and customer service tools

- Their challenge lies in modernizing legacy systems while remaining discoverable to digital-first customers.

Traditional Banking SEO Essentials

- Implement mobile-first design to meet smartphone usage trends

- Build multilingual websites (Arabic and English) for broader reach

- Create content clusters around high-intent financial keywords

4. Keyword Targeting, Local SEO, and Search Behavior

Lack of Published 2025 Search Volume Data

- There is currently a deficiency in public quantitative data specifically detailing the search engine performance of Bahraini financial institutions in 2025.

- However, search trends can be inferred from:

- High internet penetration rates (~99%)

- Mobile-first behavior (~70% mobile usage)

Potential SEO Keyword Categories

| Keyword Type | Examples | Relevance |

|---|---|---|

| High-Intent Keywords | “apply for personal loan Bahrain” | Direct conversions for core services |

| Informational Queries | “how to open a bank account in Bahrain” | Educational content and top-funnel engagement |

| Local Search Phrases | “fintech companies in Manama” | Optimized for local visibility and map packs |

| Branded vs. Non-Branded | “ABC Bank Bahrain” vs. “best digital bank Bahrain” | Competitive positioning |

5. Competitive Intelligence: Digital Players in Bahrain’s Financial Sector

Key Market Participants

| Segment | Key Players | Digital SEO Positioning |

|---|---|---|

| Traditional Banks | Bank of Bahrain & Kuwait, Ahli United Bank | Institutional trust, brand keywords |

| Fintech Startups | Tarabut Gateway, BenefitPay | API integration content, mobile-first UX |

| Islamic Finance | Ithmaar Bank, Khaleeji Commercial Bank | Niche religious-compliant financial content |

SEO Challenges by Segment

- Traditional Banks: Slow web performance, limited educational content

- Fintechs: Limited domain authority, aggressive competition

- Islamic Finance: Underutilized structured data and schema

6. SEO as a Catalyst for Financial Services in Bahrain

Strategic SEO Objectives for 2025 and Beyond

- Increase organic lead generation through inbound content and landing pages

- Build topical authority with FAQs, whitepapers, and financial calculators

- Optimize for voice and mobile search, as voice-enabled banking queries grow

- Implement local SEO to capture map-based searches for financial branches or fintech offices

SEO ROI Potential in Financial Services

| SEO Metric | Impact Area | Long-Term Benefit |

|---|---|---|

| Organic Traffic Growth | Customer acquisition | Cost-effective lead generation |

| SERP Feature Appearance | Brand trust | Click-through rate enhancement |

| Dwell Time & Engagement | Conversion optimization | Higher retention and cross-selling opportunities |

7. Conclusion: SEO as a Strategic Necessity in a Digitally Competitive Finance Sector

The finance industry in Bahrain stands at the crossroads of technological innovation and intensified digital competition. Fintech disruptors are redefining service delivery, while traditional institutions are modernizing to maintain relevance. In this environment, SEO is not merely a technical add-on—it is a strategic growth lever.

By investing in search engine optimization, financial organizations—regardless of their size or market maturity—can unlock visibility, build trust, and drive customer engagement in a digitally literate Bahraini population. Whether it’s capturing high-intent queries, delivering localized service discovery, or improving user journeys across mobile platforms, SEO has become foundational to digital competitiveness in Bahrain’s 2025 finance ecosystem.

6. Tourism Sector in Bahrain (2025): SEO as a Strategic Enabler of National Growth Targets

In 2025, Bahrain’s tourism sector is undergoing a targeted transformation aimed at revitalizing its international visibility and economic contribution. Under the strategic guidance of the national initiative Bstc 2025, the country has set forth aggressive growth objectives that place digital marketing—and more specifically, search engine optimization (SEO)—at the core of its outreach strategy. In this evolving tourism landscape, SEO emerges not only as a digital tool but as a cornerstone for economic advancement, brand positioning, and inbound visitor engagement.

1. Tourism Goals and Economic Significance

Bahrain’s 2025 Tourism Growth Objectives

- The national tourism agency, Visit Bahrain, has announced its goal to attract 53,000 international tourists in 2025.

- This target reflects a renewed commitment to global market penetration and positioning Bahrain as a viable travel destination in the Gulf and beyond.

Revenue Generation Forecast

- The anticipated tourist influx is projected to generate approximately USD 75 million in direct economic contribution.

- Revenue sources include:

- Hotel bookings

- Tour packages and activities

- Retail and food & beverage spending

- Cultural and heritage site visits

Tourism Revenue Projection Table (2025)

| Metric | Value |

|---|---|

| Targeted International Tourists | 53,000 |

| Estimated Economic Contribution | USD 75 Million |

| Average Spend Per Tourist | USD ~1,415 |

2. The Digital Tourist Journey: Why SEO Matters

Online Search as the Starting Point

- Research indicates that over 80% of global travelers begin their journey on search engines.

- Search queries often include:

- “Things to do in Bahrain”

- “Best hotels in Manama”

- “Gulf countries to visit in winter”

SEO’s Role in the Traveler’s Funnel

- Visibility during discovery and planning phases directly influences:

- Brand awareness

- Booking decisions

- Itinerary development

Search Funnel Matrix for Tourism SEO

| Funnel Stage | Common Queries | SEO Content Types Needed |

|---|---|---|

| Awareness | “Why visit Bahrain?” | Destination guides, blog articles |

| Consideration | “Top attractions in Bahrain” | Listicles, comparison pages, review content |

| Conversion | “Book hotel in Bahrain” | Landing pages, booking platforms, CTAs |

| Loyalty | “Travel tips for Bahrain repeat visits” | Loyalty program SEO, retargeting blog content |

3. National Strategy: Bstc 2025 and Digital Enablement

Overview of Bstc 2025

- Bstc 2025 (Bahrain Strategy for Tourism Competitiveness) sets a structured roadmap for:

- Boosting tourism’s GDP contribution

- Enhancing digital engagement

- Strengthening Bahrain’s brand in key source markets

Digital Priorities in the Strategy

- The initiative emphasizes:

- Search engine visibility as a priority outreach mechanism

- Online brand reputation and storytelling

- Influencer collaboration and user-generated content (UGC)

Strategic Focus Table: Bstc 2025 Objectives

| Strategic Area | Bstc 2025 Goals | SEO-Driven Execution |

|---|---|---|

| Global Visibility | Promote Bahrain internationally | Keyword ranking in target source countries |

| Brand Perception | Position Bahrain as a premium destination | Content marketing and reputation SEO |

| Experience Discovery | Showcase tourism experiences online | Schema markup, local landing pages, images |

4. Competitive SEO Tactics for Tourism Operators in Bahrain

A. Targeted Keyword Optimization

- Essential to rank for both global and local travel-related terms in multiple languages (English, Arabic, Hindi).

- Key focus areas:

- Cultural tourism: “Bahrain heritage sites”

- Luxury travel: “5-star resorts Bahrain”

- Family-friendly packages: “Bahrain with kids itinerary”

B. Mobile-First and Visual Search Optimization

- With mobile searches dominating travel queries, tourism businesses must:

- Optimize Core Web Vitals

- Use high-resolution imagery with ALT tags

- Enable image search indexing

C. Local SEO for Attractions and Services

- Critical for map-based queries like:

- “Tour guide near me”

- “Bahrain museum hours”

- Utilize:

- Google Business Profiles

- Reviews and Q&A optimization

- Location-based landing pages

D. Link Building and Travel Authority

- Collaboration with:

- Travel bloggers

- Tourism influencers

- Media outlets in source markets

- Increases:

- Domain authority

- Referral traffic

- Local content authenticity

5. SEO Strategy Alignment: Hotels, Tours, and Destination Services

| Tourism Segment | SEO Strategy Components | Key Outcome |

|---|---|---|

| Hotels & Resorts | Schema markup for rooms, multilingual booking pages | Higher direct booking rates |

| Tour Operators | Blog content, video SEO, seasonal offers | Enhanced visibility and engagement |

| Restaurants & Events | Local SEO, structured data for menus, real-time availability | Footfall from both tourists and locals |

| Cultural Attractions | Heritage keyword targeting, backlink campaigns | Broader international exposure |

6. Measuring SEO Impact in the Tourism Sector

Performance Metrics to Monitor

- Organic traffic from target countries

- Conversion rate on travel intent pages

- Keyword ranking movement (destination-specific terms)

- Bounce rate and time on site (content engagement)

Sample Tourism SEO Metrics Dashboard

| Metric | Benchmark (Tourism Sites) | Target for Bahrain Operators |

|---|---|---|

| Organic Sessions Growth MoM | +8% | ≥10% |

| Top 10 Keyword Ranking Ratio | 35% | ≥45% |

| Booking Conversion Rate | 2.5% | ≥3.5% |

| Dwell Time on Guide Pages | 2.3 mins | ≥3 mins |

7. Conclusion: SEO as a Tourism Accelerator in Bahrain’s Digital Vision

The year 2025 marks a turning point for Bahrain’s tourism industry, not only in terms of projected visitor numbers but in the strategic recalibration of how the nation positions itself globally. In a digital-first era, the success of tourism initiatives such as Bstc 2025 will be largely dictated by how well Bahrain’s attractions, accommodations, and services rank, resonate, and convert online.

SEO is not just an auxiliary marketing function—it is a strategic infrastructure layer that underpins visibility, narrative control, and engagement. For Bahrain to transform interest into arrivals and clicks into economic value, destination-wide, collaborative, and data-driven SEO efforts must become standard practice across the industry.

7. Oil and Gas Sector in Bahrain (2025): SEO’s Emerging Role in a Digitally Underserved Industry

In 2025, Bahrain’s oil and gas industry continues to serve as a bedrock of the national economy. However, as global energy markets shift and the region deepens its integration with digital platforms, a significant opportunity is emerging for the sector to leverage Search Engine Optimization (SEO). Although traditionally less consumer-facing and slower to adopt digital strategies, the sector’s increasing investor activity, international collaborations, and event-driven exposure now demand a more robust online footprint.

1. Strategic Economic Relevance of Oil & Gas in Bahrain

Sector Overview and Economic Foundation

- The oil and gas industry remains a primary contributor to Bahrain’s GDP, sustaining national revenue and industrial development.

- Bahrain’s energy infrastructure supports:

- Refining capacity through Bahrain Petroleum Company (Bapco)

- Offshore oil production from the Awali Field

- Natural gas operations and downstream petrochemicals

Emerging Investment Activity

- Regional sovereign wealth funds and conglomerates are increasingly investing in:

- Industrial services

- Energy infrastructure

- Refining and petrochemical projects

- This signals a growing corporate interest in Bahrain’s energy assets, necessitating enhanced corporate visibility online.

2. Digital Communications in the Energy Sector

Why SEO Matters in a B2B-Driven Industry

- While not inherently consumer-focused, the oil and gas sector requires digital discoverability for:

- Investor relations and financial reporting

- Talent recruitment and employer branding

- Thought leadership and technical publishing

Key Online Engagement Objectives

- Positioning as a regional hub for energy innovation

- Enhancing brand credibility among international partners

- Promoting corporate social responsibility (CSR) and ESG (Environmental, Social, Governance) initiatives

Corporate SEO Priorities Table

| SEO Focus Area | Objective | Strategy |

|---|---|---|

| Investor Relations Pages | Improve search visibility for financial content | Keyword-targeted press releases, schema implementation |

| Career Portals | Attract technical talent | Localized job SEO, structured job postings |

| ESG Reports | Showcase sustainability performance | PDF optimization, data-driven blog summaries |

| Event Participation | Leverage industry events for visibility | Event page optimization and backlink campaigns |

3. MPGC 2025: A Catalyst for Energy-Focused SEO Campaigns

Event Overview

- Bahrain will host the 32nd Annual MPGC (Middle East Petroleum & Gas Conference) in May 2025.

- MPGC is a flagship event that brings together:

- Government officials

- Executives from NOCs (National Oil Companies) and IOCs (International Oil Companies)

- Energy economists, analysts, and service providers

Search Behavior and SEO Opportunity

- Spikes in search interest occur around:

- Conference speakers and panels

- Topics such as “future of oil in GCC” or “sustainable refining”

- Bahrain-specific energy policies and investment opportunities

Event SEO Content Matrix

| Content Type | Target Keywords | Recommended Format |

|---|---|---|

| MPGC Conference Pages | “MPGC 2025 Bahrain agenda” | Optimized landing pages |

| Blog Coverage | “Key takeaways from MPGC 2025” | Long-form blog posts |

| Speaker Bios | “MPGC 2025 speaker list Bahrain” | SEO-rich bio and profile pages |

| Industry Reports | “Oil & gas outlook GCC 2025” | Downloadable whitepapers |

4. Regional SEO Benchmarking: Visibility Gaps and Opportunities

Current Limitations

- Quantitative SEO metrics for Bahrain’s oil and gas sector remain underreported.

- Leading companies like Bapco, nogaholding, and Tatweer Petroleum may have limited search performance due to:

- Lack of on-page optimization

- Absence of content marketing strategies

- Minimal use of technical SEO elements like schema markup

Proposed SEO Audit Areas

| Audit Component | Current Status (Assumed) | Opportunity for Enhancement |

|---|---|---|

| Domain Authority | Medium | Build via industry backlinks |

| Keyword Rankings | Low | Target high-volume B2B and energy-related keywords |

| Mobile Usability | Varies | Ensure mobile-first design for global access |

| Indexation & Site Structure | Often Unoptimized | Streamline sitemap, internal linking, and UX paths |

5. B2B-Focused Keyword Strategy for Oil and Gas Companies

Relevant SEO Themes

- Industry Analysis: “oil market forecast Bahrain 2025”

- Technical Services: “pipeline maintenance Bahrain”

- Energy Transition: “carbon capture Bahrain energy projects”

- Workforce Recruitment: “petroleum engineer jobs Bahrain”

Keyword Strategy Matrix

| Keyword Category | Example Keywords | SEO Content Suggestions |

|---|---|---|

| Investment & Finance | “energy investment in Bahrain” | Investor relations page, FAQs |

| Sustainability & ESG | “Bahrain oil ESG report 2025” | ESG blog series, PDF SEO |

| Talent Acquisition | “oil & gas engineering jobs Bahrain” | SEO-optimized career pages, structured data |

| Corporate News & PR | “Bapco expansion 2025” | Press release archive, newsroom section |

6. Competitive Visibility: Who’s Leading the Digital Energy Race?

| Company | Digital Footprint Strength | Website Optimization | SEO Content Strategy |

|---|---|---|---|

| Bapco | Moderate | Basic SEO | Limited blog/news content |

| Tatweer Petroleum | Low | Minimal SEO | Static informational pages |

| nogaholding | Moderate | Corporate-oriented | Potential for thought leadership blogs |

7. Conclusion: A Sector Ready for Digital Activation

The oil and gas industry in Bahrain—despite its strategic and economic weight—has yet to fully harness the power of search engine visibility. As the nation hosts global energy events, attracts regional investment, and pushes toward innovation in sustainability and technology, a proactive SEO strategy can bridge the gap between corporate influence and digital relevance.

For oil and gas enterprises operating within Bahrain, SEO offers a unique avenue to:

- Control the narrative around brand identity and innovation

- Attract top-tier global talent

- Strengthen relationships with stakeholders and investors

- Amplify exposure around international events and projects

In the evolving landscape of 2025, digital discoverability is no longer optional—it is a strategic imperative for any energy player seeking influence in the Middle East and beyond.

8. Emerging Industries in Bahrain (2025): Broadening the Scope of SEO in a Diversifying Economy

While e-commerce, finance, tourism, and oil & gas remain at the forefront of Bahrain’s economic narrative, the 2025 landscape reveals a wider array of industries embracing digital transformation and increasingly adopting SEO-driven strategies to enhance visibility, competitiveness, and scalability. The rise of sectors such as real estate, healthcare, IT services, and startups reflects Bahrain’s strategic diversification and signals a deeper integration of organic search visibility as a core pillar of digital growth.

1. Economic Diversification and Digital Maturity

Broader Industry Participation in Online Marketing

- Bahrain’s economic diversification plan under Vision 2030 has led to the acceleration of digitization across multiple sectors.

- Industries now engaging in digital and SEO strategy include:

- Real estate and construction

- Healthcare and life sciences

- Information Technology (IT)

- Professional and legal services

- Startups and innovation hubs

Increased M&A Activity as a Digital Catalyst

- The surge in mergers and acquisitions (M&A) within banking, real estate, and energy verticals often leads to:

- Rebranding and domain changes

- Replatforming websites

- Consolidation of digital assets

- These activities create a heightened demand for SEO audits, 301 redirect planning, and re-optimization of content structures.

2. Growth Trajectory of the IT Services Sector

Exponential Expansion of the IT Industry

- Bahrain’s IT services sector is projected to grow at an annual CAGR of 12.5% through 2027.

- The sector benefits from:

- Government initiatives like the Cloud First Policy

- Investment in regional data centers and infrastructure

- Rising demand for cybersecurity, AI, and SaaS solutions

Digital Marketing Dependency in IT

- IT service providers in Bahrain heavily rely on:

- Online lead generation

- Thought leadership content

- Product and service visibility in SERPs

SEO Strategic Requirements for IT Firms

| SEO Element | Application in IT Sector | Tools & Methods |

|---|---|---|

| Technical SEO | Ensure crawlability and structured content | XML sitemaps, robots.txt, schema markup |

| Long-Tail Keyword Targeting | Capture niche queries in AI, SaaS, or DevOps | Keyword clustering, pillar content strategies |

| B2B Content Marketing | Build credibility and funnel conversions | Case studies, technical blogs, eBooks |

| Conversion Optimization | Drive demo bookings and trial signups | CTA testing, CRO analytics |

3. Real Estate & Healthcare: Digitally Maturing Sectors

Real Estate Sector SEO Trends

- Real estate developers and agents increasingly focus on:

- Location-based keywords such as “luxury apartments Manama”

- Virtual tour indexing and local listing optimization

- Google Maps visibility and lead generation via organic traffic

Healthcare Sector SEO Evolution

- Healthcare providers, clinics, and healthtech startups are:

- Optimizing for health condition searches, doctor discovery, and telehealth

- Enhancing content trustworthiness (E-E-A-T) to comply with YMYL (Your Money Your Life) content standards

- Integrating SEO with online booking systems

Comparative SEO Needs Table

| Industry | SEO Priority Tactics | Patient/Client Journey Focus |

|---|---|---|

| Real Estate | Geo-targeted keywords, listing schema | Discovery → Inquiry → Viewing appointment |

| Healthcare | E-E-A-T content, local SEO, medical schema | Symptoms → Provider Search → Appointment Scheduling |

4. Startups and the Rise of Organic-First Growth Models

Startup Ecosystem Momentum

- Bahrain’s startup ecosystem is witnessing accelerated growth in:

- Healthtech, Fintech, E-commerce, and GreenTech

- Enabled by support programs from Tamkeen, Startup Bahrain, and Bahrain FinTech Bay

Why Startups Prioritize SEO

- Limited marketing budgets drive preference for:

- Cost-effective inbound marketing

- Organic customer acquisition

- Sustainable content-led lead generation

SEO Adoption Matrix for Startups

| Stage | SEO Focus | Key Metrics Tracked |

|---|---|---|

| Pre-Launch | Domain setup, keyword research | Indexed pages, crawl errors |

| Growth Phase | Blog content, backlinks, landing pages | Organic traffic, referral traffic, lead volume |

| Scaling Phase | Technical SEO, content automation | Keyword rankings, time on site, conversions |

5. Integration of SEO with National Economic Goals

Alignment with Bahrain Vision 2030

- Bahrain’s economic vision emphasizes:

- Private sector growth

- Digital infrastructure investment

- Innovation and entrepreneurship

SEO as an Economic Enabler

- By enhancing online visibility, industries can:

- Attract FDI (Foreign Direct Investment)

- Promote Bahrain as a hub for tech and healthcare

- Accelerate job creation in digital fields

Digital Ecosystem Impact Table

| Sector | Contribution to GDP (Est.) | SEO Opportunity Impact |

|---|---|---|

| IT & Tech | 6.4% | High-volume keyword markets, software solutions |

| Healthcare | 3.8% | Informational content, location-based discovery |

| Real Estate | 7.1% | Geo SEO, luxury keyword targeting, interactive UX |

| Startups | Emerging | Organic growth funnels, influencer collaborations |

6. Conclusion: SEO Beyond the Big Four

In 2025, Bahrain’s digital economy is expanding well beyond its traditional anchors. The increasing online engagement across real estate, healthcare, IT, and entrepreneurial ventures reflects a broader recognition of SEO as a foundational tool for sustainable digital visibility. As Bahrain advances toward a diversified knowledge economy, the effective use of SEO will become not just a best practice but a competitive necessity across all industry verticals.

Businesses within these emerging sectors are advised to:

- Conduct thorough SEO audits tailored to their industry

- Invest in content strategies that align with user intent and sector-specific search behavior

- Leverage local and regional keyword opportunities for hyper-targeted outreach

In a digitally integrated Bahrain, the ability to be found online will be as vital as the ability to compete offline.

9. Investment in Digital Advertising and Search Engine Marketing in Bahrain: 2025 Analysis

As Bahrain continues to advance in its digital transformation journey, digital advertising—particularly search engine marketing (SEM)—is emerging as a vital channel for businesses seeking scalable and measurable marketing performance. Though direct market-specific data for Bahrain is still limited, global trends, paired with Bahrain’s increasing digital maturity, provide strong directional insights into how digital advertising strategies are evolving within the Kingdom.

1. Global Digital Advertising Growth: A Benchmark for Bahrain

A. Accelerated Global Spending in Digital Media

- In 2025, global digital advertising spend is forecasted to exceed USD 750 billion, accounting for over 75% of total global media spend.

- This trend indicates a clear preference shift from traditional to digital channels, driven by:

- Greater audience targeting precision

- Improved measurability and ROI

- Ubiquity of digital device usage across demographics

B. Long-Term Growth Outlook

- Global digital ad revenue is expected to soar to USD 1.16 trillion by 2030, with a CAGR of 15.4% (2025–2030).

- Influencing drivers:

- Rising smartphone penetration

- Integration of AI-driven ad tech

- Sophisticated use of programmatic advertising

- Expansion of video, voice, and immersive ad formats

C. Total Global Advertising Milestone

- In 2025, for the first time, global advertising revenue is set to exceed USD 1 trillion, reaching approximately USD 1.1 trillion with a 7.7% growth rate.

- Within this growth, digital advertising remains the highest contributor, emphasizing the rising importance of online platforms, including SEM.

D. Pure-Play Digital Advertising Surge

- Pure-play digital advertising (e.g., paid search, social, display) is predicted to grow 12.4% globally in 2025.

- The relevance for Bahrain:

- Businesses are expected to follow suit, moving away from print and broadcast to digital-first ad strategies.

- Focus areas include paid search, Google Ads, social media promotions, and native content platforms.

Digital Advertising Growth Table (Global Benchmarks vs. Bahrain Projections)

| Metric | Global 2025 Forecast | Likely Trend in Bahrain (Estimate) |

|---|---|---|

| Digital Ad Spend Share of Total Media | 75%+ | 60–70% |

| Total Digital Ad Spend | USD 750 Billion | USD 300–500 Million* |

| CAGR (2025–2030) for Digital Ads | 15.4% | 10–12% |

| Pure-Play Digital Advertising Growth (2025) | 12.4% | 10%+ |

*Based on regional Gulf trends and digital adoption rates.

2. Investment Priorities: Role of SEM Within Digital Advertising

A. Search Advertising as a Performance Powerhouse

- In 2024, search engine marketing (SEM), including SEO and paid search, was attributed to 16% of the top-performing marketing channels globally in terms of ROI.

- Businesses value SEM due to:

- High intent-based targeting

- Superior conversion performance

- Flexible budget scaling

B. Global Search Advertising Spend Snapshot

- Global spending on search advertising in 2024 was approximately USD 95.0 billion.

- Google remains the dominant platform globally and in Bahrain, making Google Ads the primary SEM investment avenue for Bahraini companies.

C. Why Search Advertising Matters in Bahrain

- Given Bahrain’s:

- 99% internet penetration

- 70%+ mobile-first usage pattern

- 96%+ Google search engine dominance

- SEM becomes not just an option but a necessity for market penetration.

Strategic SEM Benefits for Bahraini Businesses

- Immediate visibility in search results

- Increased qualified website traffic

- Enhanced local and regional targeting

- Superior data analytics for ROI tracking

3. SEM Allocation and Strategy Trends

A. Expected Share of Digital Budget for SEM in Bahrain

- While precise figures for Bahrain are unavailable, extrapolating from global ratios:

- 25–35% of total digital ad spend is typically allocated to search advertising

- In Bahrain, this would translate into a spend ranging from USD 75M to 125M annually, depending on market maturity

B. Channel Prioritization Matrix

| Digital Channel | Estimated Budget Share (%) | Key Strengths for Bahraini Businesses |

|---|---|---|

| Search Engine Marketing | 25–35% | High-intent traffic, local keyword targeting |

| Social Media Ads | 30–40% | Brand awareness, audience targeting |

| Programmatic Display | 15–20% | Retargeting, real-time bidding efficiency |

| Video Ads | 10–15% | Engagement, storytelling, YouTube reach |

C. Tactical SEM Recommendations

- Focus on Arabic and bilingual keyword strategies to cater to local linguistic preferences.

- Implement hyper-local campaigns targeting searchers by city and sector (e.g., “law firm in Manama”).

- Adopt mobile-first ad formatting given mobile dominance in search traffic.

- Use dynamic search ads to improve ad relevance based on website content.

4. Data Gaps and Need for Bahrain-Specific Research

A. Market Intelligence Limitations

- There remains a gap in localized data:

- No official SEM investment breakdown for Bahrain (2025)

- Lack of published ROI comparisons between channels

- Limited transparency from local digital agencies on performance benchmarks

B. Recommendations for Enhanced Insight

- Conduct primary surveys of businesses investing in digital marketing

- Collaborate with advertising agencies and telecom firms for spend analytics

- Leverage Google Trends and Ads platform data for market-specific search behavior

5. Conclusion: SEM as a Pillar of Bahrain’s Digital Marketing Ecosystem

In the absence of detailed Bahrain-specific investment data, global trends and the Kingdom’s own digital landscape offer compelling reasons to believe that SEM holds a pivotal role in 2025 marketing strategies. As businesses compete in an increasingly online-first consumer environment, search engine marketing stands out for its ability to generate measurable, targeted, and scalable results.

SEO and paid search strategies in Bahrain should not be viewed in isolation but as integrated components of broader digital ecosystems that reflect shifts in consumer behavior, technological adoption, and market competitiveness. Going forward, data transparency and local case studies will be crucial for further refining SEM investments and demonstrating their ROI potential within Bahrain’s fast-evolving digital economy.

10. Adoption and Effectiveness of SEO Practices by Bahraini Businesses in 2025

As Bahrain continues to assert itself as a digitally progressive economy, the strategic adoption of SEO practices by businesses has become increasingly pivotal in shaping online visibility, competitive positioning, and long-term growth. Although precise Bahrain-specific data is limited, global benchmarks, regional indicators, and the country’s digital infrastructure provide valuable insight into the current state and effectiveness of SEO initiatives.

A. SEO Adoption Landscape in Bahrain (2025)

1. Digital Maturity and Market Readiness

- Strong digital infrastructure: Bahrain benefits from high-speed internet availability, wide mobile broadband access, and a digitally literate population.

- Internet penetration: Over 99% of the population has access to the internet, creating fertile ground for search-driven consumer engagement.

- Mobile-first behavior: With over 70% of online searches conducted via mobile devices, businesses are increasingly optimizing for mobile SEO.

2. Business Environment Driving SEO Uptake

- Stable economic climate: Encourages long-term digital marketing investments.

- Proliferation of SMEs and startups: Many newer enterprises adopt SEO as a cost-effective alternative to paid advertising.

- Sector-wide digitalization: Industries such as e-commerce, real estate, healthcare, fintech, and tourism are all leveraging digital channels for customer acquisition.

3. Cultural and Consumer Behavior Indicators

- Tech-savvy population: High social media usage and digital content consumption rates imply strong familiarity with online search behavior.

- Multi-device engagement: Search behavior spans mobile, desktop, and tablet—driving businesses to adopt responsive SEO strategies.

- Multilingual environment: SEO strategies increasingly accommodate both Arabic and English content, reflecting Bahrain’s bilingual search landscape.

4. Limitations in Data Availability

- While qualitative indicators suggest growing SEO adoption, quantitative data (e.g., % of businesses using SEO) is currently not published.

- Suggested sources for future insight:

- Bahrain Economic Development Board (EDB)

- Tamkeen (SME development organization)

- Local digital agencies and marketing consultants

B. Matrix: SEO Adoption Readiness Across Key Bahraini Sectors

| Sector | Digital Activity Level | SEO Adoption Likelihood | Primary SEO Focus Areas |

|---|---|---|---|

| E-commerce | Very High | High | Product listing SEO, local and mobile SEO |

| Finance/Fintech | High | Medium–High | Trust-building content, mobile-first SEO |

| Healthcare | Medium | Medium | Local SEO, health-specific informational pages |

| Real Estate | High | High | Location-based SEO, lead generation |

| Tourism | High | High | Multilingual SEO, experience-based content |

| Oil & Gas | Medium | Low–Medium | Corporate SEO, event-driven SEO (e.g., MPGC) |

C. Effectiveness of SEO and Return on Investment

1. Global Perception of SEO Effectiveness

- According to 2024 global data:

- 91% of marketers reported SEO as instrumental in improving website performance.

- SEO consistently ranks among the top digital marketing channels for long-term ROI.

2. Organic Search as a Key Traffic Driver

- Organic search accounted for an average of 33% of total website traffic across major industries.

- This illustrates SEO’s unmatched capacity to generate sustained, cost-effective, inbound traffic.

3. Strategic ROI for Bahraini Businesses

- Cost-efficiency:

- SEO requires upfront investment but delivers ongoing results without recurring ad spend.

- Particularly valuable for SMEs and startups that require scalable growth strategies.

- Conversion potential:

- Search engine users often exhibit high purchase intent.

- Ranking on the first page of Google—especially for local keywords—translates into increased leads, calls, and sales.

- Brand credibility and authority:

- Higher visibility on search results enhances brand trustworthiness and consumer perception, crucial in service-based sectors like healthcare and finance.

D. Visual Insight: SEO ROI vs. Other Digital Channels (Global Averages)

| Channel | Avg. ROI Score (1–10) | Notes |

|---|---|---|

| SEO | 8.2 | Long-term impact, low cost per click |

| Email Marketing | 7.8 | High personalization, good for CRM |

| PPC/Google Ads | 7.5 | Quick results but costly over time |

| Social Media Ads | 6.9 | Good for brand awareness |

| Influencer Marketing | 6.5 | Expensive, less measurable ROI |

E. Areas Requiring Further Localized Research

1. Local Business Surveys

- Understanding how Bahraini companies allocate digital budgets and measure SEO impact.

2. Industry-Specific Keyword Rankings

- Analysis of top-ranking websites in Bahrain’s e-commerce, finance, and real estate sectors.

3. Case Studies and Best Practices

- Success stories from Bahraini businesses that adopted SEO and experienced measurable growth.

F. Strategic Takeaways

- SEO adoption in Bahrain is well-supported by infrastructure, consumer behavior, and economic stability.

- Perceived effectiveness globally positions SEO as a vital long-term marketing asset for Bahraini enterprises.

- There is a critical need for Bahrain-specific data to evaluate performance benchmarks, case study evidence, and sectoral ROI.

- Digital agencies and policymakers should prioritize publishing local research to guide businesses in making data-driven SEO investments.

In summary, while comprehensive local adoption metrics are yet to be published, all indicators point to widespread and growing use of SEO across Bahraini industries in 2025. Businesses that proactively invest in SEO are better positioned to capture long-term digital market share, build online authority, and enhance their bottom-line performance in Bahrain’s evolving digital economy.

11. Future Trends and Outlook for SEO in Bahrain: 2025 and Beyond

As Bahrain’s digital economy advances into a more sophisticated, AI-driven era, SEO continues to evolve from a technical marketing practice into a strategic business imperative. Understanding the key forces shaping the future of search engine optimization in Bahrain is critical for enterprises looking to retain relevance, expand visibility, and secure long-term digital growth.

A. Impact of AI and Emerging Technologies on Search Engine Optimization

1. AI-Powered Evolution in Search Algorithms

- Major search engines, particularly Google, are embedding AI across core services—most notably through AI Overviews and Search Generative Experiences (SGE).

- These AI enhancements are reshaping how content is surfaced, shifting the focus from traditional blue-link SERPs to contextual answers, summarized responses, and predictive queries.

- Bahraini businesses must optimize for AI-indexable content, including FAQ-style formatting, schema markup, and structured data.

2. Strategic Integration of Generative AI

- AI content generation tools are transforming content workflows in Bahrain, enabling faster production of SEO-friendly articles, descriptions, and metadata.

- However, Google’s evolving spam policies demand a balance between automation and human-authored content that reflects Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T).

3. Influence of UGC and Decentralized Search Ecosystems

- Platforms like Reddit, Quora, and TripAdvisor are gaining increased visibility in search results as Google prioritizes authentic community-based content.

- Bahraini brands in tourism, healthcare, or F&B can benefit by:

- Engaging in community platforms

- Repurposing UGC into optimized website content

- Building backlinks from relevant discussion threads

4. Voice Search and Conversational AI Optimization

- Bahrain’s rising smartphone penetration (exceeding 95%) and growing adoption of smart home devices are catalyzing voice search behavior.

- Effective voice SEO strategies include:

- Targeting long-tail, question-based keywords

- Structuring content with concise answers and semantic markup

- Ensuring mobile page speed optimization and SSL certification

5. Rise of Video and Visual Search Optimization

- Video consumption in Bahrain, especially via platforms like YouTube, TikTok, and Instagram, is surging.

- Video SEO Essentials:

- Use keyword-rich titles and descriptions

- Add closed captions and transcripts

- Create custom thumbnails and embed schema markup

- Visual search technologies, including Google Lens, are expected to shape e-commerce and tourism search experiences.

B. Emerging SEO Strategies and Best Practices in Bahrain (2025)

1. Mobile-First Indexing and Optimization

- Given the dominance of mobile traffic in Bahrain, search engines prioritize mobile usability when determining rankings.

- Essential actions include:

- Responsive web design

- Accelerated Mobile Pages (AMP)

- Mobile Core Web Vitals compliance

2. Arabic SEO for Local Relevance

- Over 70% of Bahrain’s population speaks Arabic, making Arabic keyword research and localization a critical advantage.

- Best practices include:

- Creating native Arabic content instead of translations

- Ensuring right-to-left (RTL) compatibility

- Building Arabic backlinks and leveraging regional directories

3. Content Authority, Relevance, and E-E-A-T Implementation

- Google’s search guidelines prioritize content that reflects real-world expertise and trust.

- Bahraini businesses should:

- Publish expert-written blogs or whitepapers

- Showcase credentials, testimonials, and case studies

- Build digital PR to earn contextual, high-authority backlinks

4. Technical SEO and Structured Data Adoption

- A well-structured backend ensures discoverability and accurate indexing.

- Key technical focus areas:

- Schema Markup for reviews, events, and products

- XML sitemap submissions

- Robots.txt configuration

- Secure, fast-loading HTTPS domains

5. Local SEO and Google Business Profile (GBP) Optimization

- For brick-and-mortar businesses in Bahrain, appearing in the local pack is vital.

- Optimization checklist:

- Ensure NAP (Name, Address, Phone) consistency

- Encourage customer reviews with keywords

- Regularly update photos, business hours, and FAQs

- Use local keywords in website metadata and blog content

C. Strategic Matrix: SEO Trends and Their Tactical Implications

| SEO Trend | Description | Required Adaptation for Bahraini Businesses |

|---|---|---|

| AI-Generated Search Results | AI Overviews and predictive summaries dominate SERPs | Optimize content for featured snippets and entities |

| Voice Search | Rising use of smart devices for queries | Use natural language, Q&A content structure |

| Arabic Language SEO | Local population preference for native language | Arabic keyword research and culturally relevant content |

| Video SEO | Surge in visual media consumption | Add schema markup, optimize thumbnails and descriptions |

| Community Content Signals | UGC platforms influencing SERP credibility | Engage in forums, repurpose UGC, build backlinks |

| Local SEO | Emphasis on Google Maps and “near me” searches | Maintain and enhance Google Business Profile |

D. Visual Insight: Top SEO Priorities for Bahrain in 2025

Top 6 Strategic SEO Priorities Ranked by Importance

| Rank | SEO Focus Area | Importance Score (1–10) | Notes |

|---|---|---|---|

| 1 | Mobile Optimization | 10 | Google’s mobile-first index mandates it |

| 2 | Arabic SEO | 9 | Dominant language in the region |

| 3 | Technical SEO | 8.5 | Critical for indexing and site structure |

| 4 | Video SEO | 8 | Drives engagement and visibility |

| 5 | Local SEO | 7.5 | Especially for SMBs and service-based industries |

| 6 | E-E-A-T Compliance | 7 | Builds trust and long-term authority |

E. Key Takeaways for Bahraini Businesses

- AI integration is redefining the SERP experience—SEO strategies must evolve beyond traditional link-ranking models.

- Arabic-first content and mobile-first design will be the backbone of SEO success in Bahrain’s domestic market.

- Voice search, video optimization, and technical excellence are no longer optional but foundational pillars for visibility.

- Local SEO and Google Business Profile management are essential for service-oriented and location-based businesses.

In conclusion, the future of SEO in Bahrain is marked by rapid technological advancement, shifting user behaviors, and the rising complexity of search engine algorithms. To remain competitive and visible in a dynamic digital economy, businesses must adopt future-proof SEO strategies that balance automation, human expertise, and local relevance. The convergence of AI, content credibility, and mobile-first experiences will define the SEO success stories of Bahrain in 2025 and beyond.

12. Government Initiatives and Regulations Shaping Bahrain’s Digital Landscape and SEO Outlook in 2025

Bahrain’s steady march toward digital transformation is not a product of market forces alone—it is a reflection of strong, top-down government planning that prioritizes digital infrastructure, regulatory modernization, and economic innovation. As these public sector efforts reshape the digital environment, they also create direct and indirect ripple effects on the state of SEO in Bahrain.

A. Government-Led Digital Transformation Initiatives

1. Infrastructure Development and Digital Modernization

- The Kingdom of Bahrain has launched numerous national initiatives to enhance broadband access, expand 5G deployment, and facilitate cloud-first policies.

- Such advancements form the foundational bedrock upon which SEO-driven businesses can thrive, particularly as:

- Faster internet speeds improve mobile site performance and UX.

- Wider access increases search engine use and organic traffic potential.

2. National Strategies Promoting the Digital Economy

- The Government Program (2023–2026) outlines economic recovery through technology integration.

- Key focuses:

- Modernizing public services via digital platforms

- Enhancing digital public engagement and cyber resilience

- These initiatives bolster internet adoption, increasing the pool of potential online customers and raising the stakes for SEO optimization.

3. AI and Digital Parliament Plans

- Bahrain’s Parliamentary AI Roadmap (2025–2026) signals a broader national pivot toward artificial intelligence across sectors.

- Although aimed at governance, it indirectly fosters:

- A tech-savvy business environment

- Greater public familiarity with AI-enhanced digital interactions

- SEO efforts in Bahrain must now consider AI-driven user behaviors, including smart search and voice queries.

B. Regulatory Framework and Compliance Requirements for SEO

| Regulatory Area | Description | SEO Implications |

|---|---|---|

| Personal Data Protection Law | Similar to GDPR, ensures responsible data use | SEO practices involving tracking and analytics must comply |

| eTransaction Legislation | Governs online transactions, digital signatures, and cyber legality | Affects how e-commerce sites structure calls-to-action and trust signals |